Insights from the 2019 Transit Innovation Workshop

In October, The Transit Innovation Workshop brought together nearly 30 leaders in transit authority, data, and payment processing for an exclusive urban mobility forum in New York City. Chaired by Dr. David S. Ricketts, Harvard Innovation Fellow, the workshop addressed key issues and constraints facing transit fare collection today and into the future.

Transit agencies and financial experts shared case studies, technical presentations, and real solutions that are already shaping the future of transportation. From the pros and cons of fare capping to servicing unbanked customers, harnessing data, and implementing 5G, here are some of the workshop’s biggest takeaways.

The City of Portland Oregon Leads the Way Into Contactless Payments

TriMet is a midsize public transit agency in Portland, Oregon. Around 2010, TriMet began to develop a fare collection system that would allow urban transit to grow while evolving alongside

future innovation.

“We knew we wanted our fare policy to support a seamless, automated quick customer experience where [commuters] didn’t have to think that much about it,” explained Rhyan Schaub, Director of Fare Revenue and Administrative Services at TriMet. “Because of that, we landed on stored value as a concept.”

Tap and Cap

TriMet incorporated the usage of contactless bank cards, allowing Portland commuters to “tap” around the transit system using their contactless-enabled bank cards or mobile devices while TriMet’s backend calculates the best fare. This is similar to what Transport for London (TFL) implemented in Greater London.

TriMet also uses a stored value account that commuters spend against, and a cap is placed on how much they are charged. For example, riders can travel all day and never be charged more than $5 for a day pass. Similarly, those same users can travel as much as they like throughout the month and pay no more than the $100 monthly pass fee.

Key Highlights:

- Fare capping allows all stored value users to benefit from the savings of a monthly pass by allowing them to pay for it ride by ride instead of upfront.

- Riders don’t have to think about how to pay their fare; they just tap and ride.

- Acceptance of contactless payment allows commuters to use the same digital wallet or contactless bank card they already use.

- Intuitive interface: only 0.15% call center contacts for every Fastpass tap.

Hop Fastpass had an approximate 50% adoption rate as of October 2019, and paper tickets were phased out on December 31, 2019, which will lead to additional adoption

There is always resistance to change. Once you have done your due diligence in communicating with the public and stakeholders, it is time to effect that change. TriMet is doing exactly this as they phase out the popular ticketing flash pass app introduced in 2013 – a favorite among fare evaders, who “only launch a ticket when they see a fare inspector.”

Biggest takeaways from the process:

- Plan your development timeline so that contractors are not waiting for each other (i.e., develop and finalize APIs before finalizing UI).

- Focus fare enforcement on trains, where “social contracts” are not as strong as those between a bus driver and commuter.

- The easiest way to explain fare capping is: “earning a pass as you ride.”

New York City Bids Farewell to Metro Cards

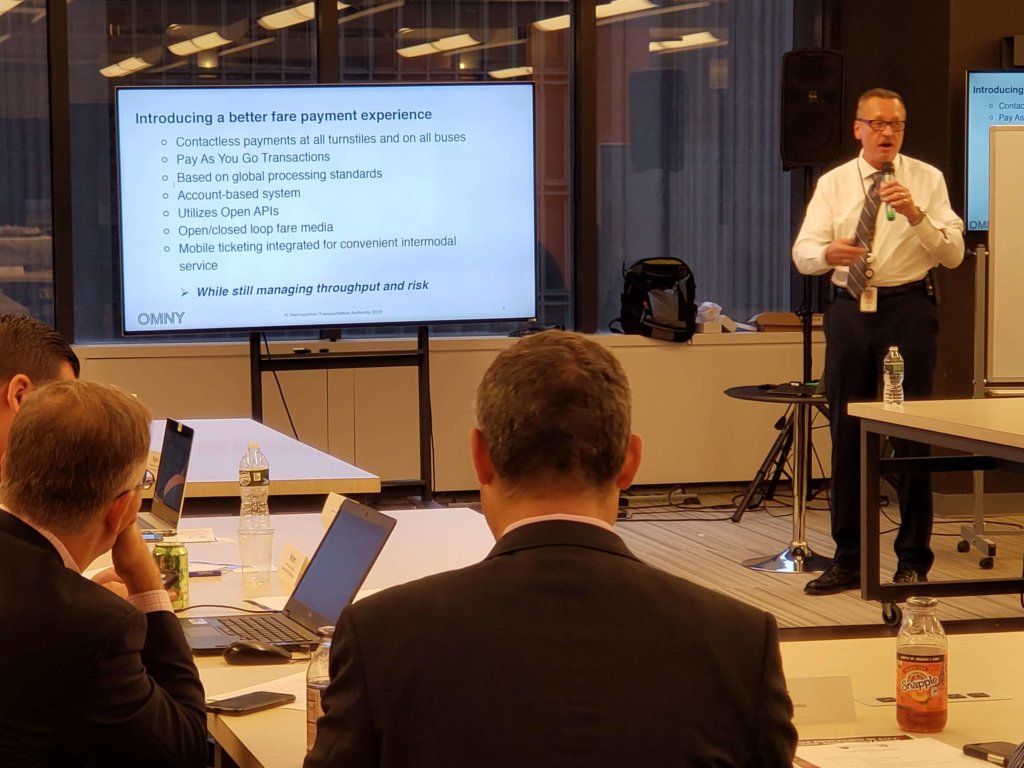

New York City Transit (NYCT) transitioned from tokens to the Metro card in 1994. Now, the city has begun to roll out an open payment system called OMNY, which launched in May 2019 on select subway stations and on all Staten Island MTA buses.

Al Putre, VP and Chief Revenue Officer for New York City Transit (NYCT) and Executive Director of OMNY Fare Payment Program at MTA estimates that there are about 80 million Metro cards in play, so the transition to open payment needs to be a painless one.

BYOC (Bring Your Own Card)

Around $1.5B in cash is processed by NYCT per year, Putre said, which has its secure facility running 25 armored cars per day. Switching to contactless fare payment will not only give commuters more choices, he added, but offer a number of other benefits to everyone involved.

Benefits of open payment systems:

- More choices for fare payment – commuters use credit cards or mobile wallets they already have. Currently, 80% of contactless transactions on currently deployed stations and bus lines are made using a mobile wallet.

- Saves time: no more waiting in line for Metro cards.

- Expectation of reduced operational costs.

Thus far, OMNY is a hit with commuters. When the system launched in May, Putre’s experts predicted between 6800-1300 transactions per week. On its first day, OMNY had 6,000 transactions despite launching at noon. The total number of taps had reached 4 million by mid-December.

According to the current timeline, all stations and buses will be outfitted with new terminals to accept contactless bank cards by Q4 2020. In addition, MTA is planning to launch new fare media through the mobile app and retail network in February 2021. The entire legacy system is scheduled to retire by July of 2023.

Biggest takeaways from the process:

- Don’t automatically take the lowest bidder. This may result in roadblocks and having to justify your decision, but it is worth it if it’s best for the project.

- Define what you want from the system and not how to design it. This approach gave MTA flexibility to adapt new capability/tech in the new system post contract award. As an example, bill recycling units with high MBTF did not exist when the MTA awarded the contract to Cubic, but it does today.

- Be agile: If the contractor fails, you fail, so adapt as you go.

- Assemble a strong team and let them do what they do best: manage them to make sure they get what they need.

- Always put the customer first, and you’ll make the right decision.

- Connectivity is key: OMNY uses active load balance data centers as a backup, but 4G has dead spots.

- 5G may solve connectivity problems, especially for underground transit, but the technology won’t be implemented quickly – or cheaply.

Tearing Down Walled Gardens

Paying for services varies significantly between retail and transit, which creates unique pain points and opportunities. Sapan Shah, Vice President of Enterprise Partnerships at Mastercard, said they are trying to build a community of agencies and cities that share information and create solutions together.

There is a commonly shared statistic that agencies have to spend an average of $14 to collect $100. Offering open payments is helping to reduce these costs on a number of levels.

Key challenges:

- When agencies become a type of currency exchange, it creates walled gardens.

- Agency contracts are often for decades, but technological change has accelerated

- Cities lack initial capital needed to implement open payment systems, don’t know how to procure the technology, or simply don’t know where to start.

In 2014, Transport for London enabled acceptance for contactless bank cards at the turnstiles The new system has decreased fare collection costs from around 14% to 9%, said, Shah.

Advantages of open payment system implementation:

- EMV acceptance at turnstiles adds extra value and creates opportunities for add-ons such as mobile wallets and other digital services.

- Anonymous data can be used to paint a larger picture of city-wide activity that includes retail and transit.

- Enabling commuters to bring their own (contactless) fare media reduces costs associated with managing closed-loop transit cards.

- Increase in ridership through increased convenience: Some agencies have reported a small increase in commuters.

- Environmental impact: Busses spend an estimated 30% of time idling while exchanging money.

Investing in Certainty

Many agencies are turning to Public Private Partnerships (P3/PPP) to mitigate risk while keeping projects on time and within budget.

Meridiam is a long-term investor, developer, and asset manager of essential infrastructure projects. Using a 25-year fund, Meridiam has invested in about 70 projects globally, ranging from rails to bridges and courthouses.

Lindsay Taylor, Senior Associate at Meridiam, says that opportunities are rising for P3 performance-based contracts for fare payment systems.

- Wide range of contract types: P3s can range from design/bid/build all the way to full design, build, operate, and maintain agreements.

- All risks are passed onto the private sector partners: payments are only received if the project is on schedule and within budget.

- Partners bid a fixed rate: this drives overall costs down and drives innovation, said Taylor.

- Whole life approach: The project’s life cycle is factored in early on to account for risks, inflation, maintenance, and technology upgrades.

- Single point of accountability: no more juggling multiple vendors.

6 Big Challenges for Open Payments

City leaders face a number of challenges implementing any change, especially one as extensive and costly as a move to open payments. Guests shared the biggest hurdles that are currently, or have previously, stood in their way.

1. Lack of experience.

2. Lack of technical capabilities and/or savviness to put it together.

3. Lack of common terminology from the market on OLP acceptance and uncertainty on the potential long-term cost of acceptance.

4. Bandwidth: Agencies working with multiple clients may find it difficult to commit the time required of a major project like a fare collection overhaul.

5. Infrastructure: the cost and time required to replace legacy infrastructure are just too great.

6. Shortage of help: agencies cited a lack of access to expertise like consultants or internal agency staff, or even supply chain vendors to help tackle a large project.

Why do people change their behavior in payments? It starts small, observed Robert Luton, Executive Vice President for MasterCard. People will change their behavior for three reasons: safety, ease, and cost or rewards.

As the former Division President for Mastercard in Japan, Luton observed an entire society change payment behavior within the span of a year or two. As a society, the Japanese prefer cash, he said, but in 2001 the city of Tokyo switched over to a contactless payment transit system (albeit not open payments). This method of payments didn’t tie into citizens’ existing use of credit cards, but it saved time that would normally be spent in line waiting for a paper ticket. And thus, adoption skyrocketed.

EMV contactless adoption starts with small transactions that consumers make every day, Luton advised. Once people get used to “tap and go” as a part of their daily routine, they start looking for opportunities to do it elsewhere.

Final Takeaways

There are many challenges that exist in transit fare collection, but one thing we learned during this innovation summit was that there are just as many opportunities. The power of partnership plays a significant role in bringing these opportunities to fruition. This includes connecting and learning from other cities, sharing ideas, and risk mitigation through P3 constructs.

[optin-monster-shortcode id=”rkyuqyepnzfmf8vpleh6″]